Policy: Enhanced Tax Credits

The Affordable Care Act’s premium tax credit (APTC) lowers what Marketplace enrollees pay for the benchmark silver plan. The enhanced APTC schedule (0–8.5% of income; no 400%-FPL cliff) is in effect through 2025, originally passed in 2021 as part of the American Rescue Plan Act (ARPA); absent new law, the schedule reverts in 2026 to the pre-ARPA structure with eligibility generally capped at 400% FPL and higher applicable percentages at many incomes. This resource page briefly explains the tax credits and the root of the issue with regard to the expiration of the enhanced tax credits.

ACA Marketplace subsidies: a quick primer

The ACA provides two main forms of financial help on the individual Marketplace: premium tax credits (PTCs) that lower monthly premiums and cost-sharing reductions (CSRs) that lower deductibles, copays, and out-of-pocket maximums on silver plans for eligible enrollees. PTCs are authorized by 26 U.S.C. §36B and are available to people without an affordable offer of employer coverage who meet income and filing criteria.

The benchmark

PTCs are keyed to the benchmark plan, defined as the second-lowest-cost Silver plan (SLCSP) available to the household in its rating area. You don’t have to enroll in the SLCSP; it’s just the reference price used to compute your credit (and is reported on Form 1095-A).

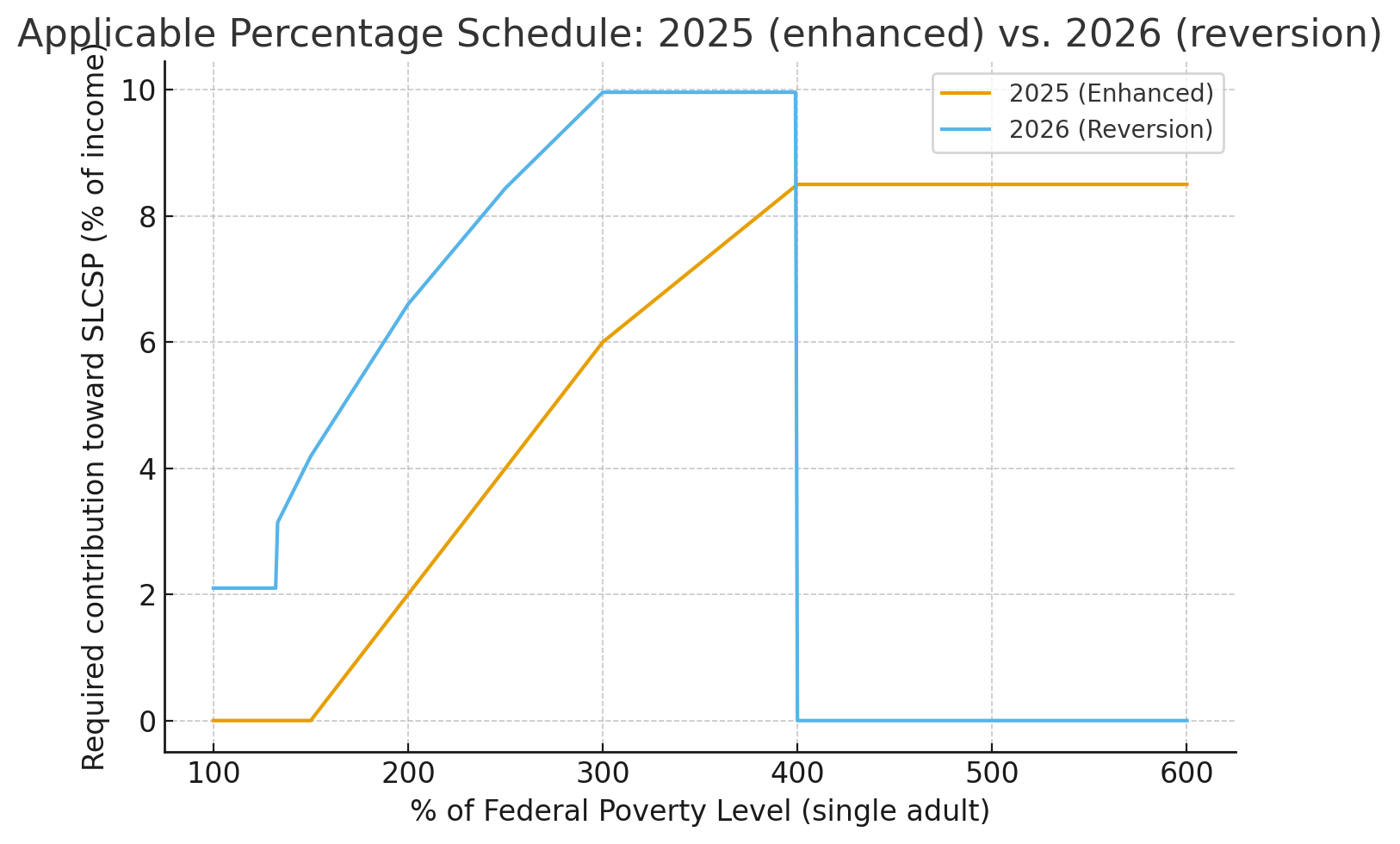

Enhanced PTCs vs. baseline

For 2021–2025, Congress temporarily enhanced the PTC schedule (American Rescue Plan, extended by the Inflation Reduction Act): required contributions are lower at most incomes and the 400%-FPL “cliff” is removed. Absent new legislation, the system reverts in 2026 to the pre-ARPA structure with eligibility generally capped at 400% FPL and higher required-contribution percentages.

Cost-sharing reductions (CSRs)

Separate from PTCs, CSRs raise a silver plan’s actuarial value (typically to 94%, 87%, or 73% for eligible households up to 250% FPL), thereby reducing deductibles and other out-of-pocket charges. CSRs only apply if you enroll in a silver plan on the Marketplace.

Why tie credits to the SLCSP?

Because the credit is pegged to a local benchmark (the SLCSP), federal assistance automatically adjusts with market prices: when benchmark premiums rise, the credit grows, cushioning net premiums for subsidized enrollees. This design is central to how the ACA maintains affordability as underlying premiums change.

Effects of Expiration

APTC at a glance

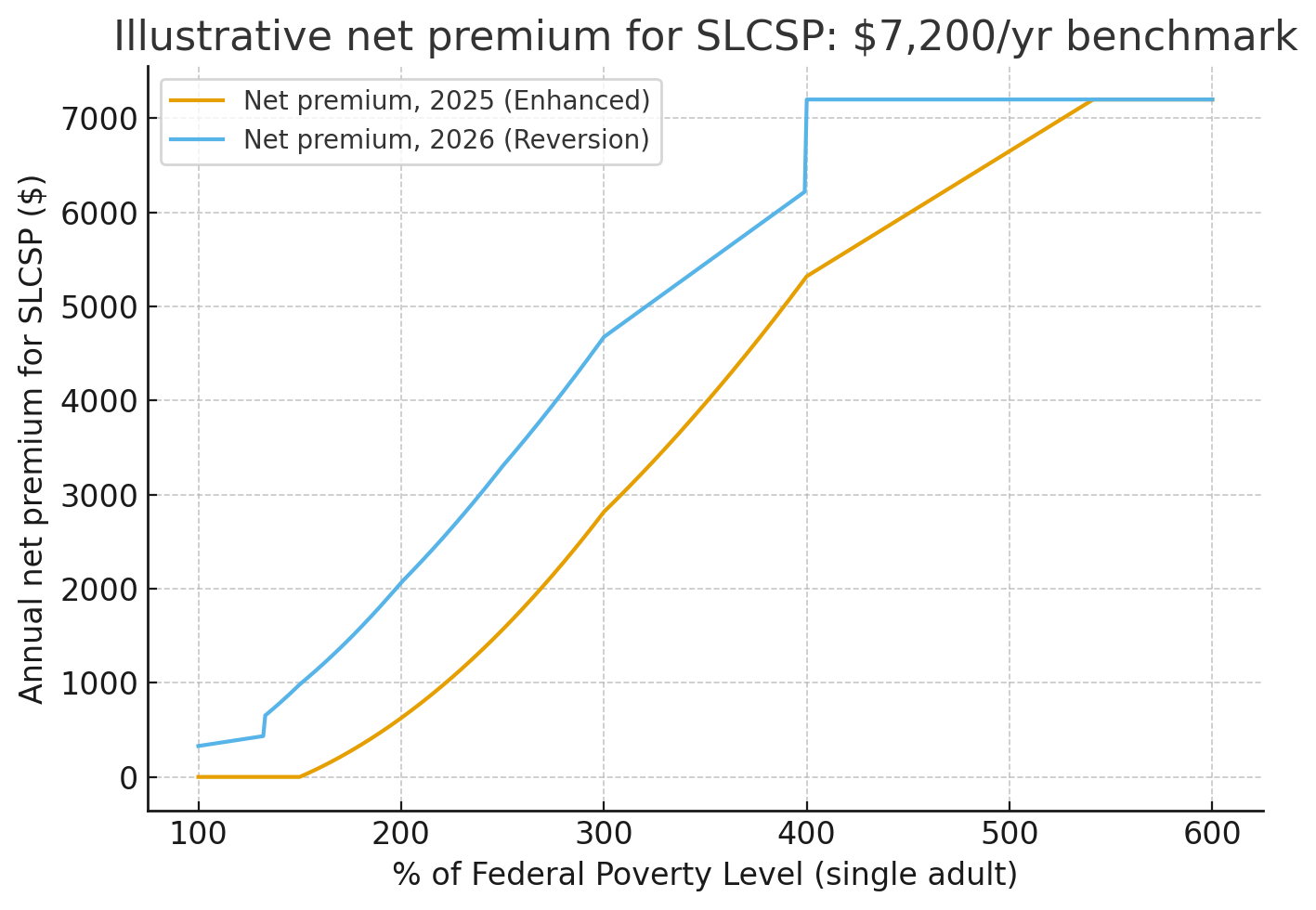

Statute & formula. The credit is defined in 26 U.S.C. §36B. For the benchmark silver plan (SLCSP):

\(\text{APTC}=\max\{0,\ \text{SLCSP}-\text{required contribution}\}\), where \(\text{required contribution}=\text{income}\times\text{applicable \%}\).2025 (enhanced) schedule. Applicable percentages are 0–8.5% across the income range and no subsidy cliff above 400% FPL (enhancement in ARPA, extended by IRA and reflected in the IRS 2025 table).

2026 reversion (if no new law). Returns to the pre-ARPA structure: eligibility generally ≤400% FPL and higher applicable percentages than 2025 at many incomes; the cliff above 400% FPL comes back.

Who benefits most. Largest dollar gains for older enrollees and for people near/above 400% FPL in high-premium areas; many <150% FPL see $0 benchmark premiums.

What is not expiring. The underlying ACA PTC (without enhancements) and cost-sharing reductions (CSRs) remain in law; some states add reinsurance or extra subsidies via §1332 waivers. For live demos, see KFF’s calculator.

Example Graphs

Assumptions for figures: single adult; 2025 HHS poverty guideline for 1 person (400% FLP is about $62,000); benchmark SLCSP = $7,200/year. Graphics are illustrative; actual amounts vary by age rating and local SLCSP.

Brief KFF Primer

References & resources

- IRS Applicable Percentage Table (2025) and explanation of ARPA/IRA adjustments.

- IRS Applicable Percentage Table (2026) and indexing for reversion.

- HHS 2025 Poverty Guidelines (for context on FPL amounts).

- Statute and regulations: 26 U.S.C. §36B; 26 C.F.R. §1.36B-1 et seq.

- Evidence on who’s most affected & calculators (KFF, CRS, BPC).